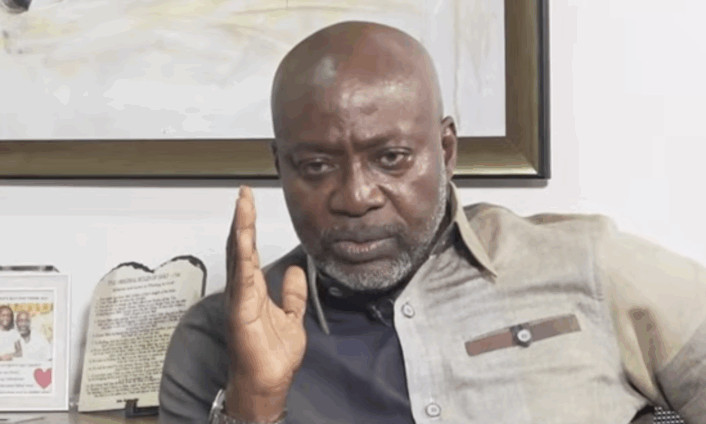

The former Chief Executive Officer of Cal Bank, Frank Adu Jnr, has opened up about his unexpected exit from the bank, revealing that he was “forced into early retirement” by the Bank of Ghana. Speaking on JoyNews’ ‘PM Express’ on Monday, June 30, the veteran banker said he holds no resentment over the move, despite the abrupt end to his nearly two-decade tenure.

In a candid interview, Mr. Adu confirmed that his departure was not by choice, stating, “Well, I say forced because I had a contract which hadn’t expired, and the Bank of Ghana Governor thought that he would use this administrative decision to cause me to take early retirement. And I bless him for it, because I think I’ve profited from that.”

The 57-year-old, who led Cal Bank through periods of significant growth and reform, clarified that his concerns lay with the process, not individuals.

“I did not blame anything on Ken Ofori-Atta,” he said, distancing the Finance Minister from the decision.

He further explained that although he believed the Bank of Ghana’s action was legally questionable, he chose not to challenge it in court.

“You cannot use an administrative fiat to frustrate an existing contract, that’s what the lawyers say,” he remarked. “There are very powerful people who suggested that I should take the issue up in court. But for me, it wasn’t necessary. What do I go to court for?”

Mr. Adu shared that he had always envisioned retiring at 55 and sees the early exit as an opportunity rather than a setback.

“Today, when I go to bed, I sleep,” he said with a smile. “I don’t have to worry about bad loans and capital adequacy ratios and all these things. So I think he did me a favour.”

His reflections add a human dimension to the wider conversation around corporate leadership and regulatory power in Ghana’s banking sector, one often marked by tension and high stakes.

Mr. Adu’s comments come amid ongoing scrutiny of the Bank of Ghana’s role in reshaping the financial landscape, particularly following a series of reforms and leadership changes across major banks in recent years.