Jomoro (W/R), June 24, GNA – The Jomoro Rural Bank could be closed down by December this year, if it failed to raise 500 million cedis as stated capital.

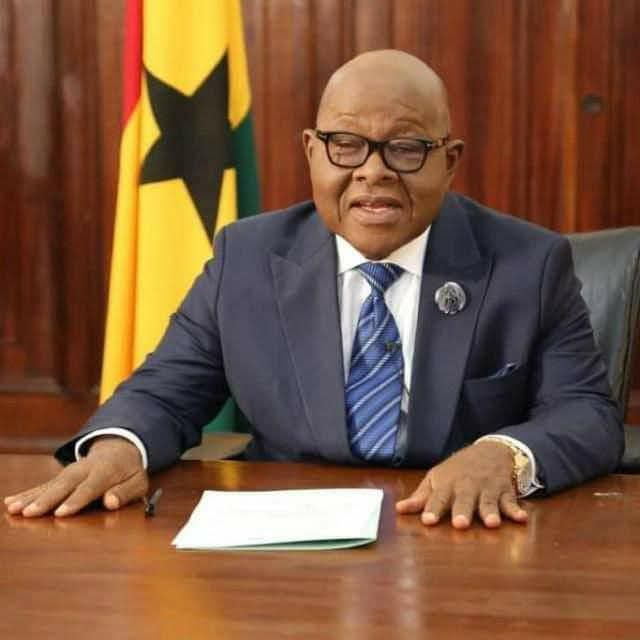

Nana Namoaka Arizie III, Chairman of the Board of Directors of the bank announced at the 11th Annual General Meeting of the bank at Jomoro on Saturday.

He said though the bank presently has 107,979.112 as stated capital, which was slightly above the mandatory requirement of the Bank of Ghana, it could loose its license, if it failed to meet the target. Nana Arizie said to avoid any closure, the management had decided to transfer 523 million cedis from its income surplus account to stated capital in compliance with section 66 of the Companies Code: 1963 Act 179.

Additionally, the bank would issue five million ordinary shares in the company to members and credited as fully paid. Nana Arizie said this new arrangement would give out one bonus share to every five shares held by the shareholders.

He said the bank earned 3.9 billion cedis last year as against 3.2 billion cedis in 2004, representing an increase of 20 per cent. It also made a net profit of 889 million cedis last year, as compared to 569 million cedis in 2004.

He said the bank however, reduced its loans and overdrafts from 7.6 billion cedis in 2004 to 4.9 billion cedis in 2005. Nana Arizie said the reduction was as a result of non-payment of loans contracted by clients.

He said presently 4,913.6 million cedis was still outstaying as at 2005, while in 2004 a total of 7,626.4 million was also unpaid. Nana Arizie said the re-payment of the loans were slow and frustrating. He told the shareholders that every effort was being made to re-structure the micro-finance operations to make it more viable. Mr Theophilus Obeng, Regional Manager of ARB APEX Bank in Takoradi said the lack of a project officer had accounted for the low granting of loans and advances.

He advised the management to find alternative strategies that would enable them to collect overdue loans from its customers. Mr Obeng noted that multiple registration and collection of loans by clients could account for the non-payment. He advised management to strengthen its internal control mechanisms to minimise fraud and ensure efficient operations.

Source: GhanaWeb